-

Welcome to LoanKeeper

A Complete Software Solution for Credit Institutions

-

Why LoanKeeper?

Virtually Endless Feature List

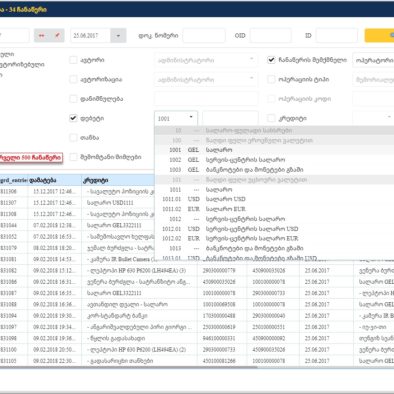

Loan portfolio tracking, accounting, financial reporting, cash-desk, money transfers, pawnshop, utility payments, currency conversions, etc.

Unlimited Analytic Possibilities

1000-s of ready to go reports + report designer

24/7 Support and Consulting

A software system without servicing answers no challenge. We know it.

Compliant with all regulations

NBG, AML, UNSL, PEP, IFRS-9

Integration with external systems

SMS, UCC, TBCPAY, Nova, TransGuard, Accuity, Mobile Apps, Web Apps, Currency Boards - we help you integrate anything

Automate Daily Tasks

Operation day close, loan cover module, SMS sending, currency rate retrieval

Constantly Innovating

New ideas and new technologies are always welcome here

Security and Operational Risk Management

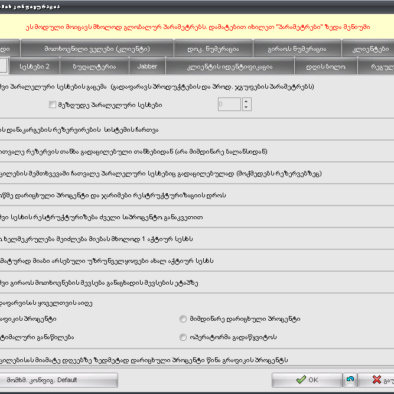

Multi-level authorizations, user group permissions, event logging - everything you need to 100% cover your risks

About Product

Dolphin Software team proudly presents LoanKeeper – a powerful and flexible instrument for running and managing your credit institution.

LoanKeeper is a perfect solution that tracks loan portfolio data and day-to-day operations for credit companies, like banks, MFI-s and pawnshops.

LoanKeeper is a feature-rich, unique and flexible system that will finally solve all of your company’s issues with loan tracking and operational risks. It includes all types of loans products, cash-desk, currency exchange and pawnshop modules, operation day management, full accounting, credit analysis and financial reporting.

The main advantage of our system is its almost endless feature list which had been thoroughly production-tested for years. Despite this, it is permanently being developed and improved. Our team members have 20 years of experience in banking and microfinance. This is what keeps Dolphin Software at leader’s position on Georgian market since 2004.

Along with software solution we provide our partner companies with uninterrupted service, highly qualified consulting and regular software updates, which provide compliance with today’s dynamic market trends and regulatory requirements.

Please feel free to contact us and see LoanKeeper at its best – in daily action.

Feature List

General Features

- Full compliance with NBG regulations

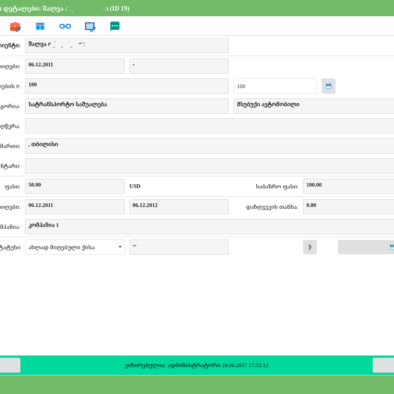

- Loan module (Consumer, pawn, business loans)

- Integrated accounting

- Front-desk (cash-desk, currency exchange, money transfers, utility payments)

- Credit and financial reporting

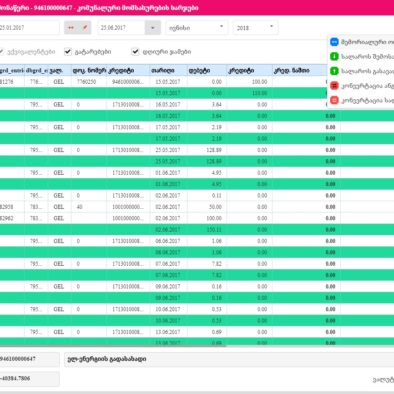

- Multi-user, multi-currency, multi-branch

- Multi-Language Interface (UNICODE)

Clients

- Inidividuals, groups, companies

- Customizable dynamic client fields

- Required field sets

- Client Watchlists and Blacklists

- Client Relationships

- Client-wide custom reports and printed forms

Applications and Committees

- Screenings, applications

- Application pipeline process

- Multiple level credit committees

- Customizable dynamic application fields

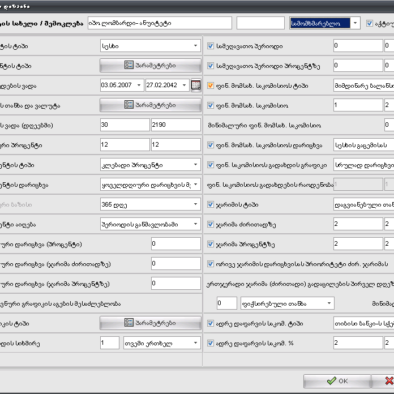

Loan Amortization Schedules

- All types of amortization schedules, fully customizable

- Custom repayment frequency, installment rounding, etc.

- Skippable holidays, week days and month days

- Manual schedules

- Flexible Reschedule

- Loan calculator

Interest, Penalties, Fees

- Flat and declining interest rates

- Effective interest rate (XIRR)

- Variable accrual basis

- Disbursement fee

- Life insurance fee

- Daily overdue penalties and penalty limiting

- Advanced loan repayment fee

- Third party-related expenses

- NBG compliant fees, commissions, effective rates

Other Loan Related Features

- Loan products and product groups

- Automatic loan loss reserve forming

- Client and loan monitorings

- Loan tags, notes, reminders

- Additional dynamic fields in client, application, loan and collateral modules

Day-End

- Day-EndInterest and penalty daily accruals

- Automatic currency daily reapprisals

- Loan loss reserve daily forming

- Loan overdue daily tracking

- Financial result forming

- Authorization of financial operations and other actions

Loan Documents

- Loan and collateral agreement form designer

- Printed form designer for custom reports

- Document numeration templates

- Printed form designer for any credit event

Collaterals

- All types of collateral tracking

- Real estate, equipment, movable collateral, vehicles

- Precious metals

- Financial guarantees

- General (frame) agreements

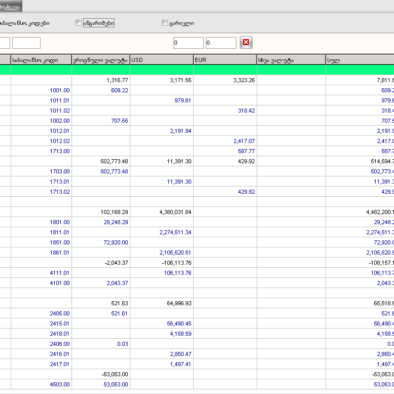

Reporting

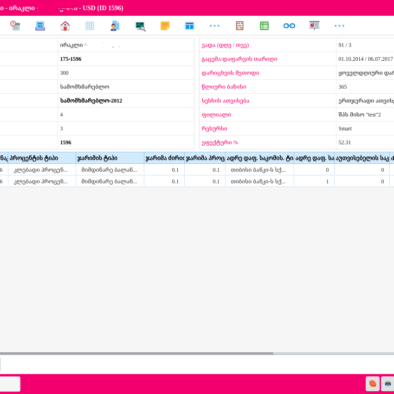

- 1000-s of preset reports for loan portfolio analysis

- Accounting and financial reporting

- NBG and AML reports

- General Ledger, Income Statement, Balance Sheet

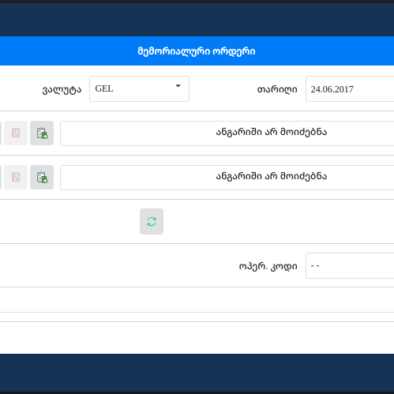

Accounting

- Company’s full accounting and operational day

- Fully automated credit-realted accounting

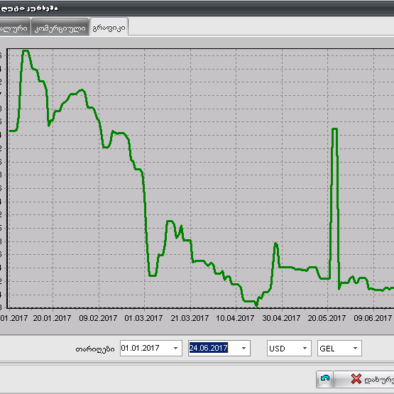

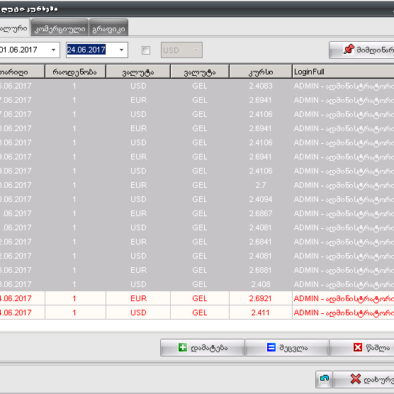

- Cash-desk and FOREX modules

- Official and commercial curreny rates management

- Financial Results, IS, BS

Security

- User and user-group permissions

- User password complexity / expiry control

- Multi-level credit event authorization

- Multi-level accounting entry authorization

- Even log

Interface

- Full UNICODE Support

- User-modifiable language packs

- Easy and Streamlined

- Windows and Web Clients

LoanKeeper

Dolphin Software

Price

- Initial installation (including 5 user seats) - 30.000 ₾

- Annual tech support fee per User - Loan Module + Accounting - 1.200 ₾

- 1 additional user seat - 4.800 ₾

Would you like to see more?

Feel free and fill form below and we will contact you!